Where the techniques of Maths

are explained in simple terms.

Financial Maths - Credit cards.

Test Yourself 1 - Solutions.

- Algebra & Number

- Calculus

- Financial Maths

- Functions & Quadratics

- Geometry

- Measurement

- Networks & Graphs

- Probability & Statistics

- Trigonometry

- Maths & beyond

- Index

1. (i) 3 to 10 January: (10 - 3) + 1 = 8 days. (ii) 18 to 28 February: (28 - 10) + 1 = 11 days. (iii) 16 March to 13 April: So total in the period = 16 + 13 = 29 days. (iv) 21 May to 24 June: So total in the period = 11 + 24 = 35 days. |

|

| 2. (i) 22.5% ÷ 12 = 0.01875%

(ii) 22.5% ÷ 365 = 0.000616% NOTE: it is the problem of leading zeros and so many digits that makes calculations so much easier to use the direct fraction - |

|

3.  |

|

| 4. | |

| 5. | |

| Calculating interest. | 6. (i) (ii) |

7.  |

|

| 8. | |

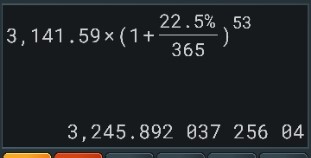

9. DO NOT convert the interest rate to a daily rate and write out the decimals. You will make an error. Instead write it as a fraction Now take the three components of this question separately. (i) the balance on 15 April of $3,141.59 plus interest: To 6 June, there are 16 days to finish April (don't forget to start with 15 April as Day 1), 31 days in May and 6 days in June - so 53 days in total.

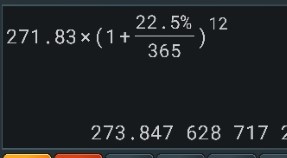

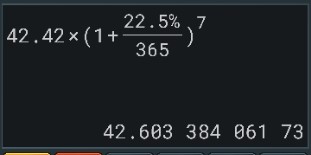

The following display shows that the screen on your calculator looks like:

(ii) purchase on the 20 May of $271.83 plus interest: To 6 June, there are 12 days to finish May and 6 days in June - so 19 days in total.

(iii) purchase on 31 May of $42.42 plus interest: To 6 June, there is 1 day to finish May and 6 days in June - so 7 days in total.

So, adding these three results together reveals that Gloria has a balance of $3,562.34 on her credit card when she makes her next payment on 6 June. |

|

| 10. | |

| Reading a statement. | 11. The computer entry is charged interest for 11 days. Closing balance = $1,258.50 Minimum payment = 5% × $1,258.50 = $62.93. |

| 12. | |

. That is then used (for compound interest) in the calculator as

. That is then used (for compound interest) in the calculator as . This way our number correponds exactly to the number given in the question - and we can see that.

. This way our number correponds exactly to the number given in the question - and we can see that.